Understanding the Concept of Assets

Before diving into the meaning of depreciable assets, it's important to have a clear understanding of what assets are. In the simplest terms, assets are resources that a company owns and can provide future economic benefits. They can be tangible or intangible. Tangible assets are physical items like buildings, machinery, and vehicles, while intangible assets include things like patents, trademarks, and copyrights.

The Concept of Depreciation

Depreciation is a method used to allocate the cost of a tangible asset over its useful life. It reflects the wear and tear, deterioration, or obsolescence of an asset. In other words, as an asset is used over time, it loses value, and this loss in value is what we refer to as depreciation.

The Definition of Depreciable Assets

Now that we have a basic understanding of what assets and depreciation are, we can define depreciable assets. Depreciable assets are tangible assets that a company expects to use for more than one accounting period and lose value due to wear and tear, deterioration, or obsolescence. These assets include machinery, buildings, vehicles, and equipment.

Importance of Depreciable Assets in Business

Depreciable assets are crucial in any business operation as they contribute to the production of goods and services. They also play a significant role in tax deductions. Companies can deduct the cost of these assets as a business expense, thus reducing their taxable income.

Categories of Depreciable Assets

Depreciable assets can be classified into three main categories: machinery and equipment, buildings, and vehicles. Each category has a different rate of depreciation based on its estimated useful life. This rate is determined by the IRS and varies from one country to another.

How to Calculate Depreciation

There are several methods to calculate depreciation, including the straight-line method, declining balance method, and units of production method. Each method has its own advantages and disadvantages, and the choice of method depends on the nature of the asset and the company's financial strategy.

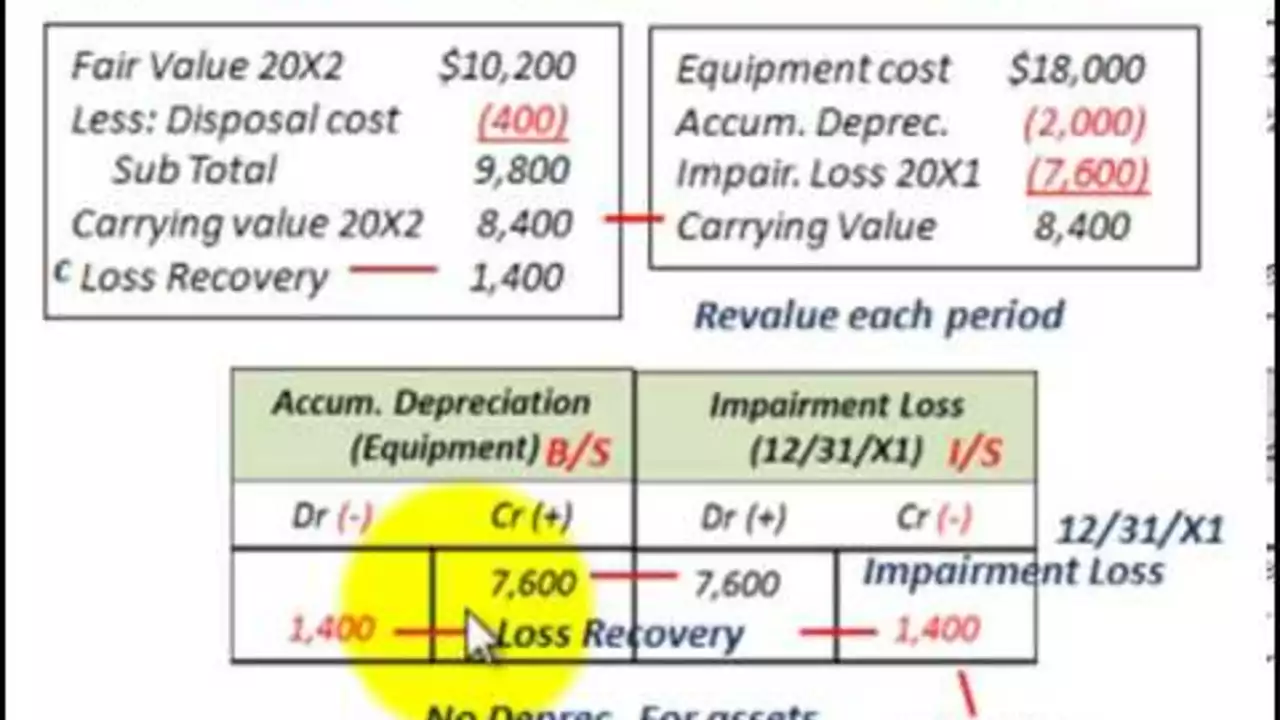

Understanding Accumulated Depreciation

Accumulated depreciation refers to the total amount of depreciation expense that has been recorded for an asset since the date of its acquisition. It's a contra asset account, meaning it has a credit balance and is subtracted from the asset's cost to determine its book value.

Depreciable Assets and Tax Implications

The depreciation of assets has significant tax implications for businesses. Since depreciation is considered a business expense, it reduces a company's taxable income, thereby reducing its tax liability. However, the tax laws regarding depreciation can be complex, so it's advisable to consult with a tax professional.

Common Misunderstandings About Depreciable Assets

There are several common misconceptions about depreciable assets. Some people think that depreciation is a cash outflow, but it's not. It's an accounting concept that reflects the aging and use of an asset. Others believe that all assets are depreciable, which is also not true. Only tangible assets that lose value over time are considered depreciable.

Conclusion: The Role of Depreciable Assets in Business Success

Depreciable assets play a crucial role in a company's success. They contribute to the production of goods and services, provide tax benefits, and help businesses monitor their assets' value over time. Understanding the concept of depreciable assets is essential for anyone involved in business or finance.